Introduction

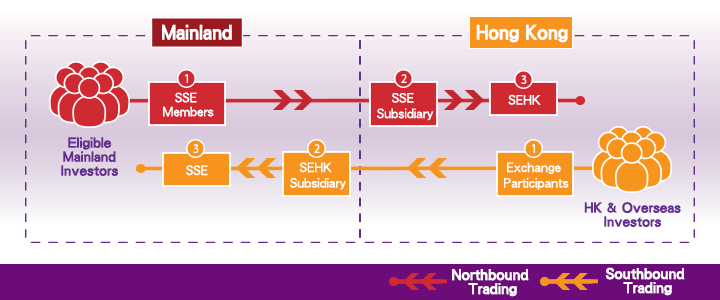

Shanghai-Hong Kong Stock Connect is a securities trading and clearing links programme developed by Hong Kong Exchanges and Clearing Limited (HKEX), the Shanghai Stock Exchange (SSE) and China Securities Depository and Clearing Corporation Limited (ChinaClear), aiming to achieve a breakthrough in mutual market access between the Mainland and Hong Kong.

Trading Arrangement

Northbound Trading: Hong Kong and overseas investors may buy stocks listed in Shanghai within the scope of Shanghai-Hong Kong Stock Connect.

Southbound Trading: Mainland investors may buy stocks listed in Hong Kong within the scope of Shanghai-Hong Kong Stock Connect.

Illustration of Order Flow

Eligible Investors

All Hong Kong and overseas individual and institutional investors are eligible to participate in northbound trading.

Eligible Stocks

|

Index components |

SSE 180 Index*, SSE 380 Index* |

|

Stocks listed in both Shanghai and Hong Kong |

A shares of companies listed on both SEHK (H Share) and SSE (A Share)* |

* Excluding stocks on the risk alert board and stocks not traded in Renminbi.

Investment Quota Restriction

|

Aggregate Quota |

RMB300 billion ▪ Calculated at the end of each trading day ▪ Balance: Aggregate Quota – aggregate buy trades + aggregate sell trades |

If Aggregate Quota Balance < Daily Quota: ▪ Suspend buy order input for the next trading day If Aggregate Quota Balance increases to Daily Quota level: ▪ Resume buy order input for the next trading day |

|

Daily Quota |

RMB13 billion ▪ Calculated real-time during trading hours ▪ Balance: Daily Quota – Buy Orders + Sell Trades + Adjustments (e.g. Buy Order cancelled, Buy Order rejected by SSE, Buy Order executed at a better price) |

If Daily Quota balance ≤ 0: ▪ During opening call auction (Pre-opening): Reject new buy orders until daily quota balance becomes positive (e.g. due to Buy Order cancellation) ▪ During continuous auction (continuous trading): Suspend buy order for the remaining of the day ▪ Buy orders already input before suspension will not be affected |

Trading Session

|

SSE Trading Session |

SSE Trading Hours |

Time for SEHK Exchange Participants to input Northbound orders |

|---|---|---|

|

Opening Call Auction |

09:15 - 09:25 |

09:10 - 11:30 |

|

Continuous Auction (Morning) |

09:30 - 11:30 |

|

|

Continuous Auction (Afternoon) |

13:00 - 15:00 |

12:55 - 15:00 |

- During the period from 09:20 a.m. to 09:25 a.m., SSE will not accept order cancellation;

- During the period from 09:10 a.m. to 09:15 a.m., from 09:25 a.m. to 09:30 a.m. and from 12:55 p.m. to 01:00 p.m., orders and order cancellations can be accepted by SEHK but will not be processed by SSE until SSE’s market opens;

- Orders that are not executed during the opening call auction session will automatically enter the continuous auction session.

Shanghai-Hong Kong Stock Connect operates only on trading days for both Shanghai and Hong Kong markets. If the fund settlement day is not a trading day in Hong Kong, Northbound Trading will be closed on the previous trading day.

|

|

Mainland China |

Hong Kong |

Open for Northbound Trading? |

|

|---|---|---|---|---|

|

Day 1 |

Business Day |

Business Day |

Yes | |

|

Day 2 |

Business Day |

Business Day |

Not open |

Settlement Cycle Hong Kong market closes |

|

Day 3 |

Business Day |

Holiday |

Not open |

Hong Kong market closes |

|

Day 4 |

Holiday |

Business Day |

Not open |

Mainland market closes |

Trading Rules

|

Trading Currency |

The stocks in Northbound Trading are traded and settled in Renminbi by Hong Kong and overseas investors. |

|

Settlement Cycle |

Stock settlement: Trading day (T) Fund settlement: T+1 |

|

Swing trading (Day trading) |

Not allowed Hong Kong and overseas investors who buy SSE Securities on T-day can only sell the stocks on and after T+1 day. |

|

Board Lot |

All SSE Securities are subject to the same trading board lot size, which are 100 shares. (Buy orders must be placed in board lots) Odd lot trading is only available for sell orders and all odd lots should be sold in one single order. It is common that a board lot buy order may be matched with different odd lot sell orders, resulting in odd lot trades. |

|

SSE Price Limit |

Price limit of ±10% based on previous closing price. Any orders with a price beyond the price limit will be rejected by SSE. The upper and lower price limits will remain the same on the same day. |

Taxes and Fees

Taxes and fees related to northbound trades under Shanghai-Hong Kong Stock Connect:

|

Fees |

Rate |

Charged by |

|---|---|---|

|

Handling Fee |

0.00487% of the consideration of a transaction per side |

SSE |

|

Securities Management Fee |

0.002% of the consideration of a transaction per side |

CSRC |

|

Transfer Fee |

0.002% of the consideration of a transaction per side 0.002% of the consideration of a transaction per side |

ChinaClear HKSCC |

|

Stamp Duty |

0.1% of the consideration of a transaction on the seller |

State Administration of Taxation |

Inclement Weather Conditions

|

Scenario |

Northbound Trading |

Fund settlement (for T-1 position) |

Securities settlement (for T position) |

|---|---|---|---|

|

Typhoon No.8/Black rainstorm signal issued before Hong Kong market opens (i.e. 9:00 a.m.) and discontinued after 12:00 noon |

Not open |

No |

Not applicable |

|

Typhoon No.8 issued between 9:00 a.m. and 9:15 a.m. |

Not open |

Yes |

Not applicable |

|

Typhoon No.8 issued after SSE market opens (i.e. 9:15 a.m.) |

Trading will continue for 15 minutes after Typhoon No.8 issuance, thereafter, only order cancellation is allowed till SSE market close |

Yes |

Yes |

|

Black rainstorm signal issued after HK market opens (i.e. 9:00 a.m.) |

Trading continues as normal |

Yes |

Yes |

|

Typhoon No.8/Black rainstorm signal discontinued at or before 12:00 noon |

Trading resumes after 2 hours |

Postpone to 3:00 p.m |

Yes |

Source: HKEx

The information above is for reference only. It is subject to changes with respect to the implementation of Shanghai-Hong Kong Stock Connect or the promulgation or enactment of the relevant laws, regulations, agreements and other documents. Notice will not be issued upon any changes. For the latest news on Northbound Trading, please visit the HKEX website.